New technologies are transforming business insurance. Automation is quickly replacing standard work. Diamond Forms, Flows & Docs automates time-consuming processes, giving you more time for personal customer contact.

Prevent errors and unnecessary work in business insurance; This reduces costs and reduces risks. Diamond is well known in the insurance industry.

Meet the highest security and GDPR requirements.

Diamond's flexibility allows you to respond immediately to changes in your industry. Deliver the speed and experience your clients expect with digital forms and automated workflows.

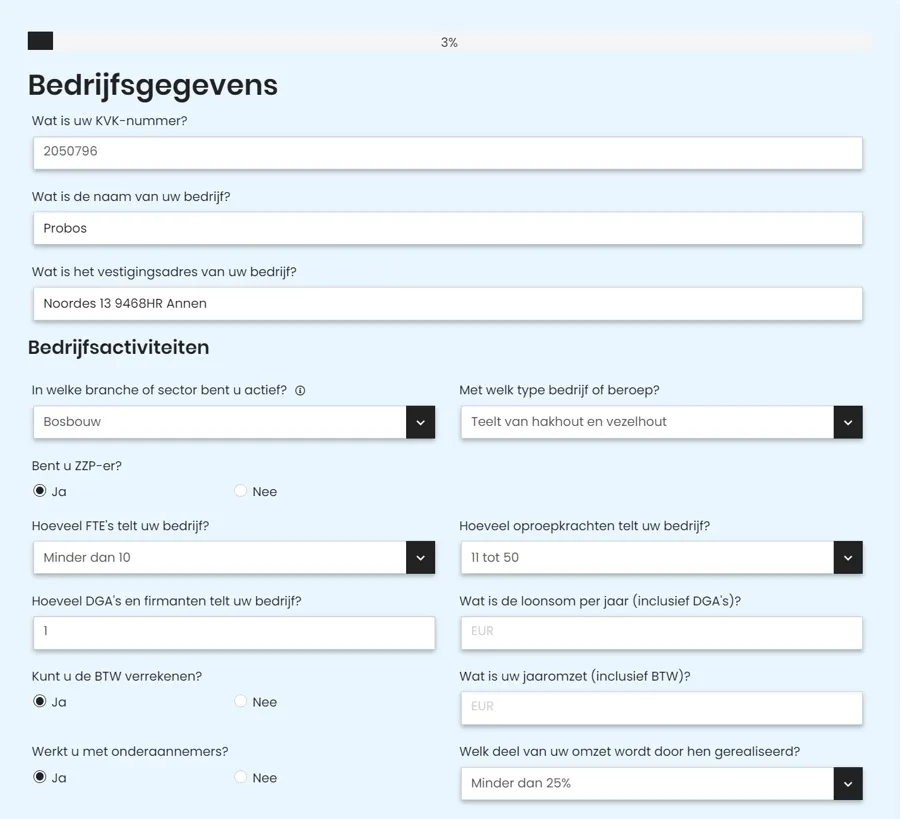

Request quotes

Due to the complexity of the products, it is not yet common practice in the business insurance market to offer online services. With the flexible calculation tool, brokers can offer liability insurance directly online to their business customers.

For complex calculations you can link our forms via the data connector to your trusted Excel files or external calculation tools. Your customer is immediately informed. In addition, prospects, customers and brokers can request a calculation online. Does your Excel change? Then you can immediately upload a new version and it will be online immediately.

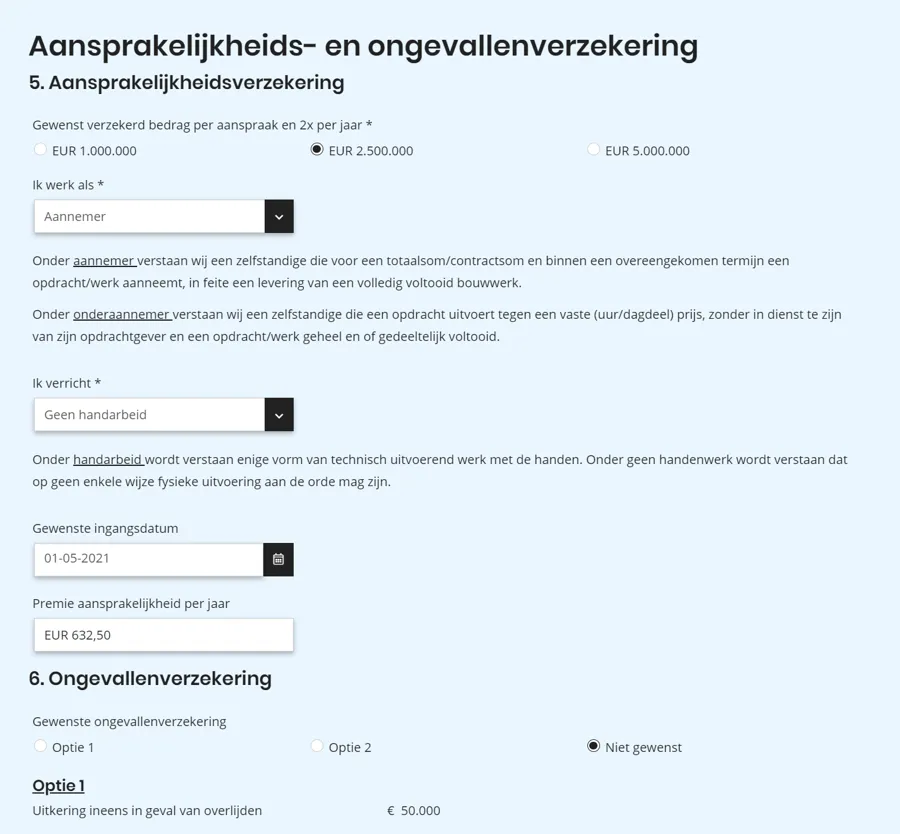

Speed is increasingly important when issuing specific liability insurance policies. Within the current processes, policy applications are received via e-mail. These are then manually adopted for premium calculation and put on the sanctions list for checking before a quotation can be drawn up. This complicated and time-consuming application process is a thing of the past with Diamond Forms, Flows & Docs.

The premium is immediately calculated and displayed in the forms during the application. A trip can also be made to the VNAB Sanctiepl@tform, so that it is immediately clear whether the insurance can be taken out in the context of compliance. After a successful payment, your relation will receive the certificate, the policy and the invoice by e-mail within a few minutes.

Issue policies

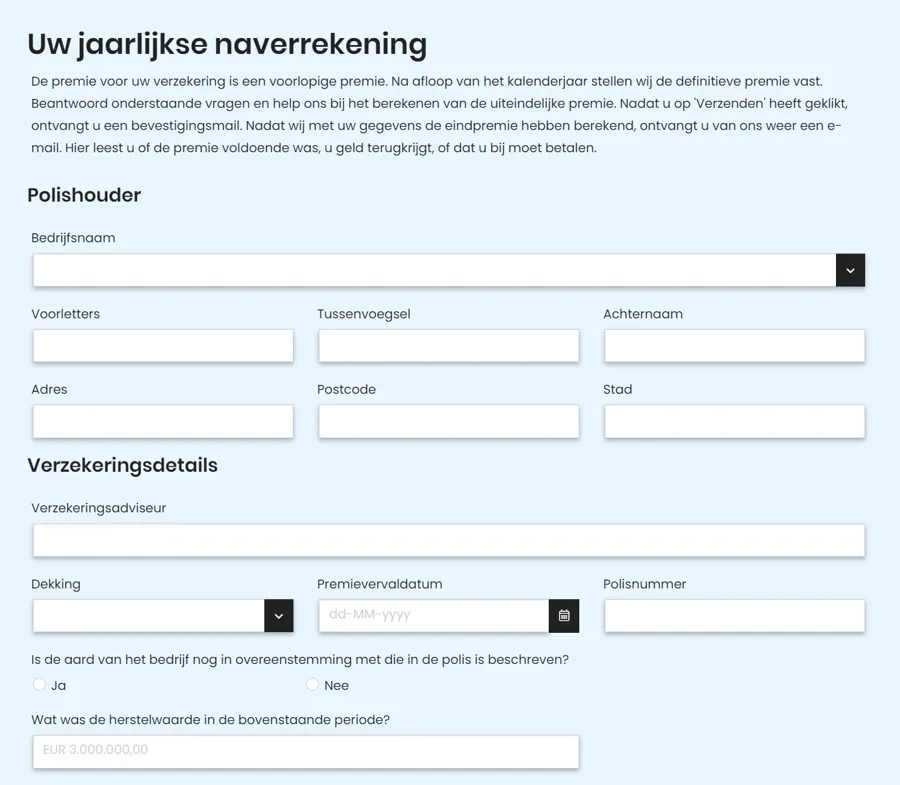

Calculate adjustments

You can count on Diamond during this entire process. For example, information that is already known can be entered in advance and the policyholder only has to enter the information for his insurance policies and covers. This means that data only needs to be entered once. A relief for your relationship.

After the forms have been prepared, relations will receive an invitation by e-mail to check the data and supplement it where necessary. After the internal check, the answers can be automatically placed and processed in your back office.

With Diamond's short, friendly and efficient forms, your relations experience a more personal approach. Their responses are processed quickly and efficiently, making them feel confident doing business with you.

In Diamond you can easily create a multilingual, pre-filled form with which you can ask your relations for the identity of the UBO and they can digitally sign it.

Naturally, the requested data can be forwarded directly via the data connector to your own applications or, for example, the VNAB Sanctiepl@tform.

UBO check

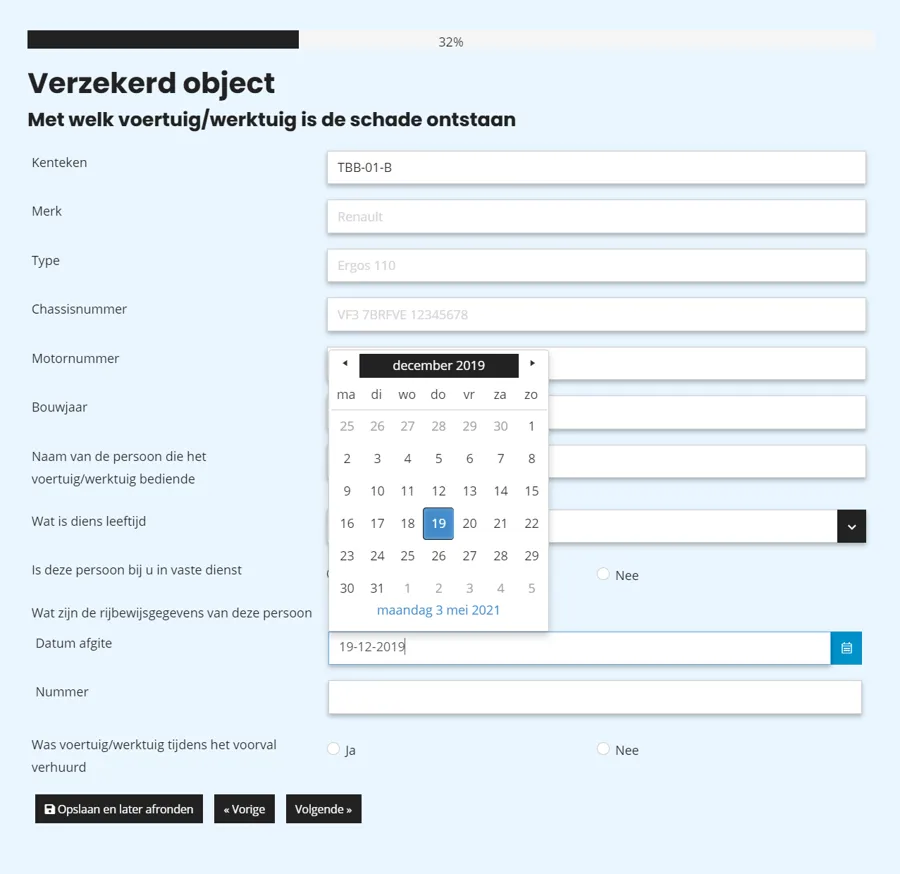

Process claims

Processing damage claims in the business market is a complex task. Damage dealers work like a spider in the web together with brokers, lawyers and loss adjusters. With Diamond you ensure that all necessary information is available in the right way. From the moment a claim is reported, you start the procedure with Diamond and you keep an overview of the various steps.

Work with chain integration and prevent unnecessary tasks, unnecessary typing and errors. Run your business smoothly and stay in control.

Call +31 85 042 00 71 or send a WhatsApp